CATALYTIC CAPITAL LAB

CATALYTIC CAPITAL LAB

The Catalytic Capital Lab will test early applications of blended and catalytic capital as a way for social finance intermediaries to launch and grow their operations, attract more investment, and generate more local impact.

The Challenge: How can we build enabling systems that support smaller, place-based social finance intermediaries to launch, grow, and thrive?

Canada has an unprecedented opportunity ahead of us. With the rise of impact investing and the launch of the Social Finance Fund announcement, there is a growing interest in mobilizing and redirecting capital to address local communities’ most pressing challenges.

To date, impact investing has been primarily deployed through venture funds and ESG public markets, neither of which are effective or available to smaller, place-focused social enterprises, whether non-profit or for-profit. In addition, neither mainstream financial institutions nor developmental lenders are adequately serving this market or this need.

Within this context, social finance intermediaries, smaller place-based and impact-first funds, are working to deploy catalytic capital in local communities.

Supporting the health of these funds is critical to addressing existing capital gaps and ensuring that the full spectrum of impact investing is realized in Canada.

Social finance intermediaries provide the following benefits:

- Provide early-stage and growth capital to diverse organizations and entrepreneurs that are overlooked by the traditional financing system, yet deliver high social, environmental and cultural value to local communities.

- Provide wrap-around supports to impact entrepreneurs and organizations to help them grow and become more investment-ready.

- Connect such enterprises to a wider network of supports and increase access to capital.

- Help impact organizations and entrepreneurs access traditional capital by acting as second-rank lenders and reducing the risk profile.

“Catalytic capital is that essential ‘made, not found’ piece of the puzzle. It is patient, flexible, risk-tolerant financing. Sometimes it accepts lower returns to accommodate the economics of high-impact organizations that are profitable but not profit-maximizing, whether due to an early stage of business development, tough markets, or a focus on impoverished populations.”

– Debra Schwarts, MacArthur Foundation

PROJECT DETAILS

A collaboration between social finance intermediaries and changemaking funders & foundations.

PROJECT DETAILS

A collaboration between social finance intermediaries and changemaking funders & foundations.

Download the Catalytic Capital Lab Presentation Deck

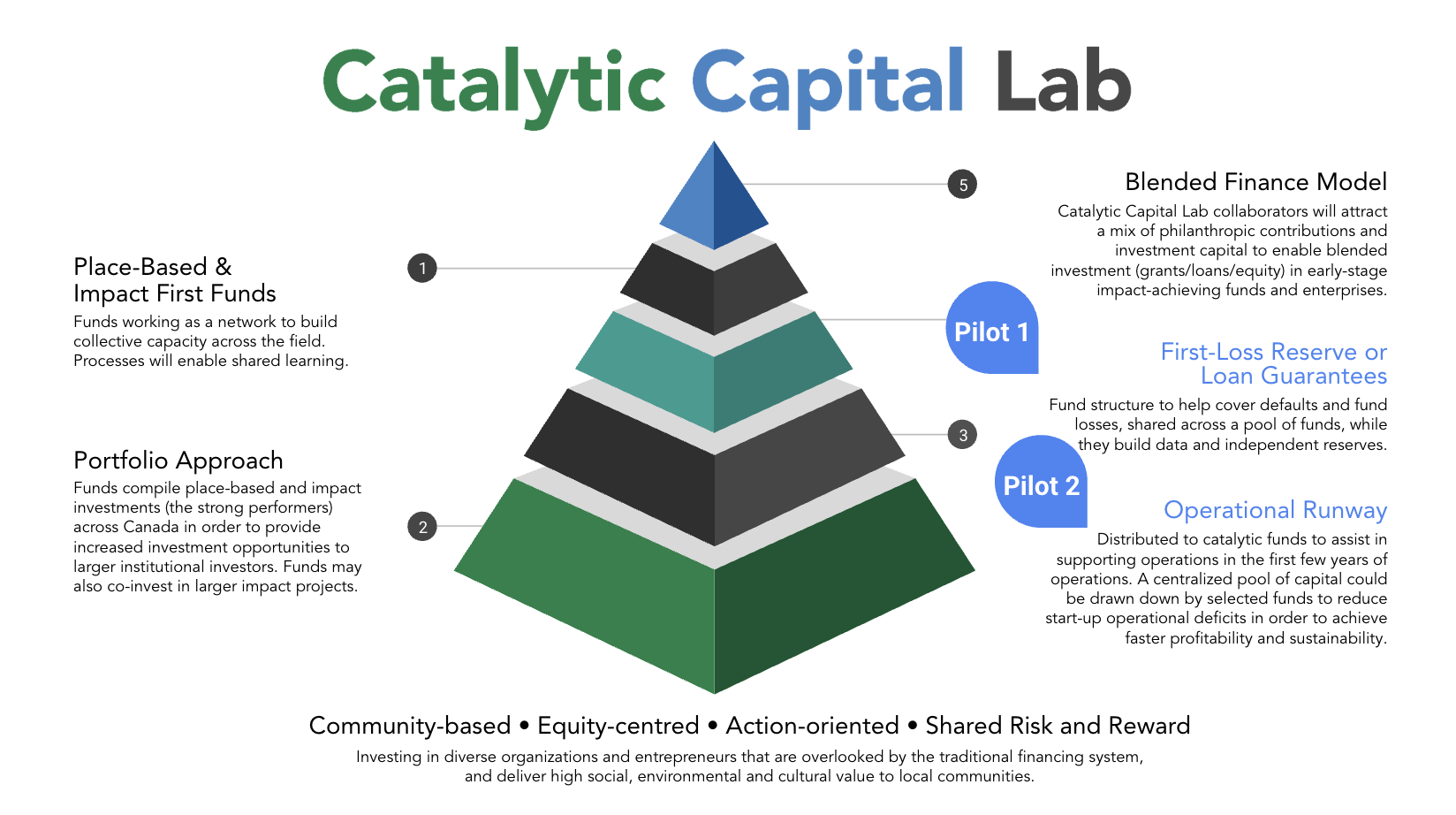

PROJECT GOALS

The Catalytic Capital Lab will support the development of social finance intermediaries, as a sector, by piloting the following:

Place Based and Impact First Funds

Funds working as a network to build collective capacity across the field. Processes will enable shared learning.

Operational Runway

Distributed to catalytic funds to assist in supporting operations in the first few years of operations. A centralized pool of capital could be drawn down by selected funds to reduce start-up operational deficits in order to achieve faster profitability and sustainability.

First-Loss Reserves Or Loan Guarantee Pool

Fund structure to help cover defaults and fund losses, shared across a pool of funds, while they build data and independent reserves.

Portfolio Approach

Active coordination between funds in order to provide increased place-based and impact investment opportunities across Canada to larger institutional investors. Funds may also co-invest in larger impact projects.

Blended Finance Model

Catalytic Capital Lab collaborators will attract a mix of philanthropic contributions and investment capital to enable blended investment (grants/loans/equity) in early-stage impact-achieving funds and enterprises.

PROJECT GOALS

The Catalytic Capital Lab will support the development of social finance intermediaries, as a sector, by piloting the following:

Place Based and Impact First Funds

Funds working as a network to build collective capacity across the field. Processes will enable shared learning.

Operational Runway

Distributed to catalytic funds to assist in supporting operations in the first few years of operations. A centralized pool of capital could be drawn down by selected funds to reduce start-up operational deficits in order to achieve faster profitability and sustainability.

First-Loss Reserves Or Loan Guarantee Pool

Fund structure to help cover defaults and fund losses, shared across a pool of funds, while they build data and independent reserves.

Portfolio Approach

Active coordination between funds in order to provide increased place-based and impact investment opportunities across Canada to larger institutional investors. Funds may also co-invest in larger impact projects.

Blended Finance Model

Catalytic Capital Lab collaborators will attract a mix of philanthropic contributions and investment capital to enable blended investment (grants/loans/equity) in early-stage impact-achieving funds and enterprises.

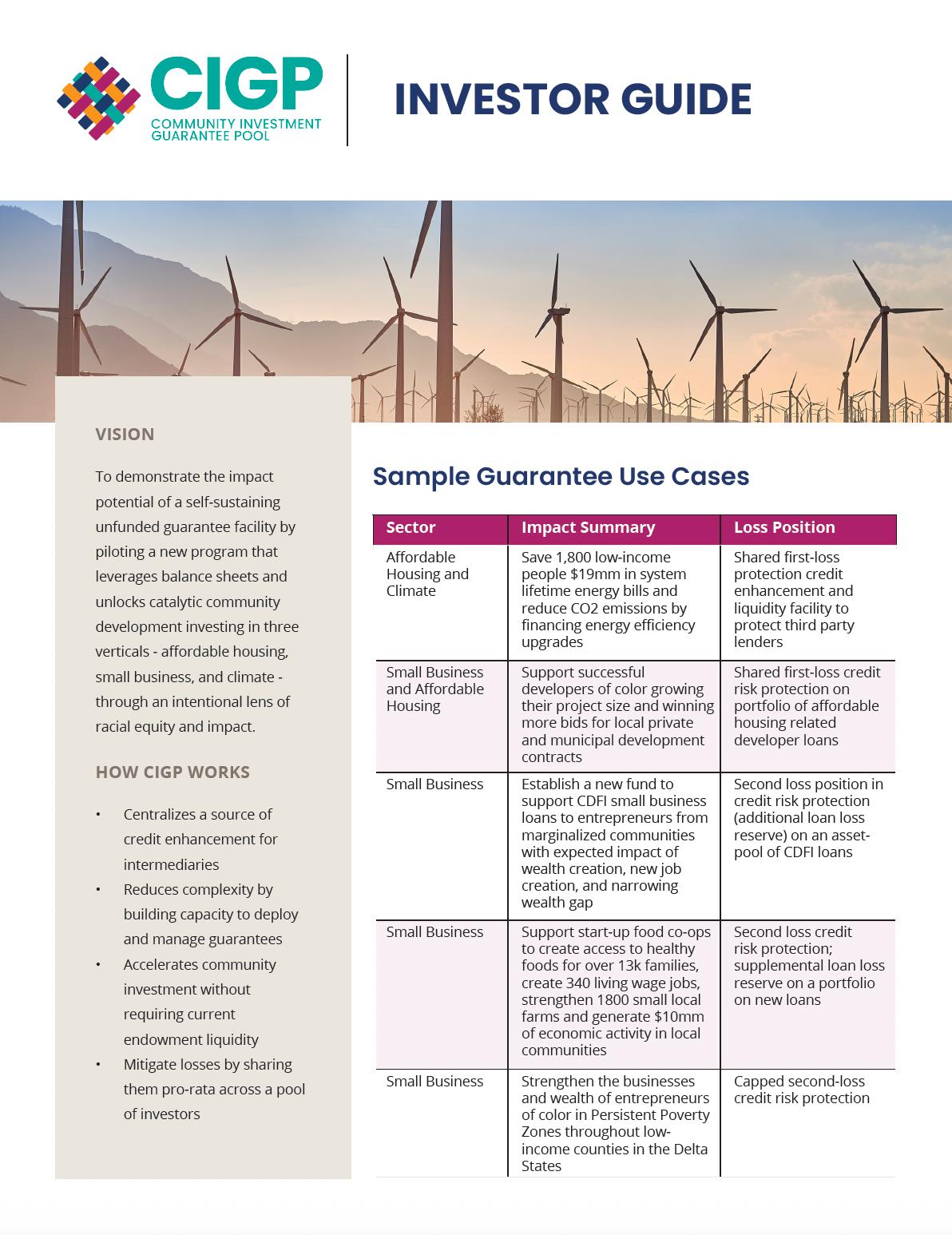

CATALYTIC LOAN GUARANTEE POOL

The Impact Guarantee program strengthens and grows Canada’s social finance intermediaries through a pooled loan guarantee facility for social finance intermediaries.

Visit the Impact Guarantee Wesbite

Learn more about the Impact Guarantee program, and apply to join as a Social Finance Intermediary or Guarantor at www.impactguarantee.ca

Read Our Pre-Budget Consultation in Advance of the Fall 2025 Budget

Catalytic Capital Lab submitted a Pre-Budget Consultation to the House of Commons Standing Committee on Finance in Advance of the Fall 2025 Budget, requesting that the Canadian Government endorse and participate in the Impact Guarantee program as part of a comprehensive social finance strategy for Canada. Read our full submission by clicking below.

CATALYTIC LOAN GUARANTEE POOL

The Guarantee Pool increases the growth of social finance in Canada by aggregating guarantees from governments, foundations, and other values-driven system leaders.

Visit the Impact Guarantee Website

Learn more about the Impact Guarantee program, and apply to join as a Social Finance Intermediary or Guarantor at www.impactguarantee.ca

Read Our Pre-Budget Consultation in Advance of the Fall 2025 Budget

Catalytic Capital Lab submitted a Pre-Budget Consultation to the House of Commons Standing Committee on Finance in Advance of the Fall 2025 Budget, requesting that the Canadian Government endorse and participate in the Impact Guarantee program as part of a comprehensive social finance strategy for Canada. Read our full submission by clicking below.